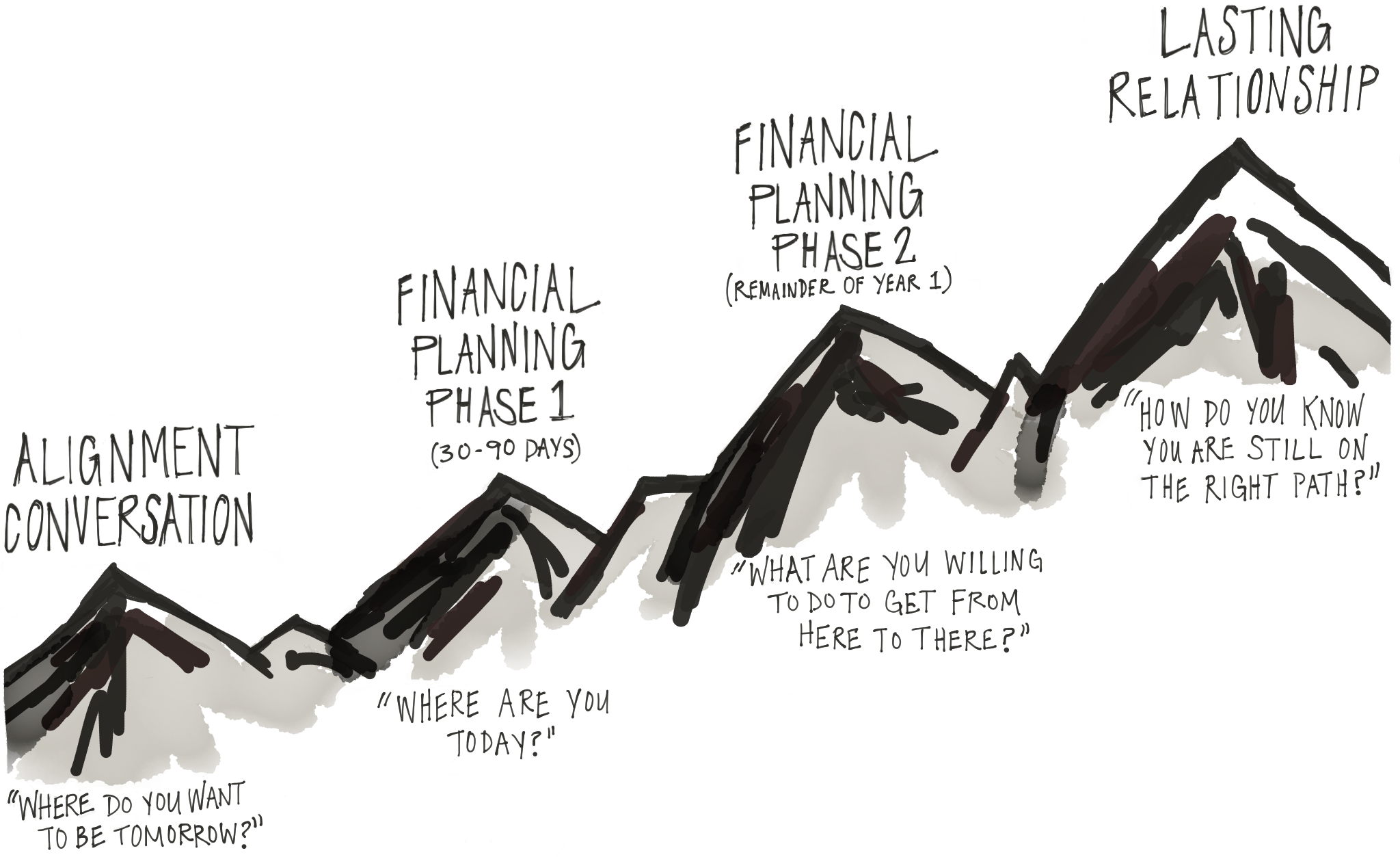

ALIGNMENT CONVERSATION: "Where do you want to be tomorrow?"

Our first step is an Alignment Conversation where we help you define and clarify the outcomes you desire. We want to understand what you would do if you had plenty of time and expertise. Typically, our clients deeply value caring service, intelligent financial advice, and the kind of work ethic they know is required to build a strong future.

You built your future. We’ll make the plan to preserve it. As you begin interacting with our team, you will experience our universal, unwavering respect for you, your family, and the future you built. You will be given opportunities to be as hands-on or as hands-off as you prefer, we’ll give feedback when appropriate, and your decisions are respected as final. It’s your future. We’ll help you make the plan that safeguards it.

PLANNING PHASE I: "Where are you today?"

Our process depends on a well-developed balance sheet, a clear understanding of cash flow, and intelligent investment risk assessment reports. Early on, we’ll identify the greatest opportunities and biggest risks between you and your dreams.

PLANNING PHASE II: "How can you reach your ideal future?"

Once we understand your current financial position and desires for the future, we plan specific steps to achieve the growth you hope to see. From assessing your insurance products and minimizing tax exposure to guiding you through significant financial events, estate planning, and managing your investments, we are extensive in service and meticulously detailed. We love collaborating with the other professionals who are making you and your financial goals their focus.

LASTING RELATIONSHIP: "How do you know you are still on the right path?"

Your financial advisor should be a trusted support. We care about creating the kind of relationship you can depend on for life.

It’s a process not a project. We ask our Alignment Conversation questions many times over our journey. Your answers will change. Laws change, new dangers present themselves, and new opportunities arise. Here are some the the ways we stay sharp for you:

Quarterly Portfolio Reporting

Tax Return Review

Risk Management Review

Current Financial Position Reports

Ongoing Investment Management

Estate Transfer Review

Constantly learning to become an even better guide. We ask for feedback to learn where else we can help and what more we can take off your plate. Over time, our working relationship will be tailored to your preferences so that you experience us as a welcome companion.

Our Fiduciary Responsibility to You

As fiduciaries we are bound both legally and ethically to act on your behalf. We are required to put your interests ahead of our own, with a duty to preserve good faith and trust.